Price action trading is a methodology used by traders to analyze and make decisions in financial markets based primarily on the historical price movements of an asset, rather than relying on external factors or technical indicators. This approach involves examining the patterns and fluctuations in an asset’s price to identify potential entry and exit points for trades, as well as to gauge the overall market sentiment. By observing the price behavior, traders can develop a better understanding of market psychology and the supply and demand dynamics that drive price changes.

In practice, price action traders focus on several key elements, including support and resistance levels, trend lines, chart patterns, and candlestick formations. Support and resistance levels are crucial for understanding areas where buying and selling pressure is likely to emerge, while trend lines help traders identify the direction of market movements. Chart patterns, such as head and shoulders, double tops and bottoms, and triangles, provide potential trade setups based on their historical tendency to repeat.

Finally, candlestick formations offer insights into the balance of power between buyers and sellers in a given time frame, helping traders spot potential reversals or continuations. By combining these elements, price action traders aim to make informed decisions in their quest for profitable trades, with the belief that historical price behavior can provide valuable clues about future price movements.

The Basics of Price Action Trading

The basics of price action trading revolve around the study of an asset’s historical price movements to make informed trading decisions. This approach emphasizes the importance of price data as the primary source of information, as opposed to relying heavily on technical indicators or external factors. Price action traders closely observe how prices change over time, focusing on elements such as support and resistance levels, trend lines, chart patterns, and candlestick formations.

By developing a solid understanding of these elements, traders can identify potential trading opportunities, gauge market sentiment, and anticipate future price movements. This method aims to provide a more direct, adaptable, and intuitive way to analyze and trade various financial markets, including stocks, forex, commodities, and cryptocurrencies.

Wikipedia Price Action Trading

Wikipedia

Understanding Support and Resistance Levels

Support and resistance levels are crucial components of price action trading, as they provide insights into the market’s underlying supply and demand dynamics. Support levels occur when buying interest is strong enough to prevent prices from falling further, indicating a concentration of demand. Conversely, resistance levels are points where selling pressure is sufficient to stop prices from rising, suggesting a concentration of supply. Identifying these levels helps traders pinpoint potential areas where price reversals or consolidations may occur, providing valuable information for trade planning and risk management.

To effectively analyze support and resistance levels, traders often examine historical price action, looking for recurring instances where prices have stalled, reversed, or consolidated. These levels can be observed on various timeframes, with higher timeframes typically providing more significant levels. Additionally, traders may use trend lines, moving averages, and Fibonacci retracement levels to further refine their analysis. It is essential to remember that support and resistance levels are not fixed points but rather zones where price action is likely to be influenced by market participants. By incorporating support and resistance analysis into their trading strategy, traders can enhance their understanding of market psychology and make more informed decisions in their pursuit of profitable opportunities.

Trend lines: Identifying Market Direction

Trend lines are essential tools in price action trading for identifying the prevailing market direction and potential areas of support and resistance. By connecting a series of higher lows in an uptrend or lower highs in a downtrend, trend lines visually represent the trajectory of a market’s price movement. These lines can help traders to determine whether they should adopt a bullish or bearish bias, as well as to identify potential trade entries and exits based on price reactions to the trendline.

To effectively draw trend lines, traders should look for multiple points where price has touched the line without breaking through it. The more touches a trendline has, the stronger and more significant it is considered to be. When a trendline is broken, it may signal a potential trend reversal or the beginning of a consolidation phase. However, it is crucial to consider the broader market context and other technical factors before assuming a break in the trendline indicates a change in market direction. By incorporating trend lines into their price action analysis, traders can better understand the market’s underlying structure and make more informed decisions about their trades.

Analyzing Chart Patterns for Trade Setups

Analyzing chart patterns is a fundamental aspect of price action trading, as they offer insights into potential trade setups based on recurring price formations. These patterns emerge from the collective psychology of market participants and can help traders anticipate future price movements. Common chart patterns include triangles, double tops and bottoms, head and shoulders, and flags and pennants. To effectively analyze chart patterns, traders should understand their formation criteria, characteristics, and potential outcomes. By recognizing these patterns and applying proper risk management, traders can capitalize on the opportunities they present and make more informed trading decisions.

Candlestick Formations: Reading Market Sentiment

Candlestick formations are integral to price action trading, as they provide valuable insights into market sentiment and the balance of power between buyers and sellers. Originating from Japanese rice traders in the 18th century, candlestick charts depict the open, high, low, and close prices of an asset within a specific time frame. Individual candlesticks can reveal information about the strength and conviction of market participants, while a series of candlesticks can help identify potential reversals or trend continuations. By studying candlestick formations such as dojis, hammers, engulfing patterns, and morning or evening stars, traders can gauge market sentiment and make better-informed decisions about their trades.

Trading Breakouts and Reversals with Price Action

Trading breakouts and reversals with price action focuses on capturing significant price movements due to shifts in market sentiment and momentum. Breakouts occur when price surpasses key levels or chart patterns, signaling a strong continuation in that direction. To effectively trade breakouts, traders should look for confirmation through increased volume, momentum, and price follow-through.

Reversals represent a change in the prevailing market trend and can be identified through candlestick formations, chart patterns, or a failure of the market to maintain a direction. When trading reversals, traders should exercise patience and wait for proper confirmation before entering a position. Combining sound risk management techniques with an understanding of price action allows traders to successfully navigate breakouts and reversals, capitalizing on the opportunities they offer.

Risk Management in Price Action Trading

Risk management is a crucial component of price action trading, as it ensures the preservation of trading capital and helps traders maintain a consistent approach to their trades. Effective risk management involves defining and adhering to rules regarding trade size, stop-loss placement, and profit-taking levels. By carefully considering the potential risks and rewards of each trade, traders can strike a balance between maximizing profits and minimizing losses, ensuring the long-term success of their trading endeavors.

One common risk management technique used in price action trading is the application of stop-loss orders, which automatically close a position when the price reaches a predetermined level. This helps traders limit their losses in case the market moves against them. Additionally, traders may use position sizing strategies, such as risking a fixed percentage of their account balance on each trade, to maintain a consistent risk exposure across different market conditions. By incorporating these risk management principles into their trading strategy, price action traders can better control their potential losses, safeguard their trading capital, and ultimately enhance their overall trading performance.

Combining Price Action with Other Technical Analysis Tools

Combining price action with other technical analysis tools can enhance trading strategies by providing additional context and confirmation for trade setups. Tools like moving averages, RSI, MACD, and Bollinger Bands can complement price action analysis, helping traders gain a deeper understanding of market dynamics.

For example, moving averages can identify trend direction and support or resistance areas, while oscillators like RSI and MACD can gauge momentum and spot reversals or divergences. It’s important to use these tools as complementary elements to price action, rather than as standalone criteria. Integrating price action with other technical analysis tools helps traders develop a more robust and well-rounded trading approach, capitalizing on the strengths of each method.

Developing a Price Action Trading Plan

Developing a price action trading plan is essential for consistent success. A well-structured plan provides a framework for decision-making and discipline. Traders should define clear goals and objectives, establish rules for trade setups, entry and exit points, and risk management techniques based on price action analysis.

Backtesting the trading plan on historical data is crucial to assess effectiveness and make adjustments. Maintaining a trading journal can help track progress and refine the plan over time. Regularly reviewing and updating the plan ensures focus, discipline, and adaptability to changing market conditions, increasing the likelihood of long-term success.

Price Action Trading Strategies for Different Timeframes

Price action trading strategies can be applied across various timeframes, catering to different trading styles and objectives. Short-term traders, like scalpers and day traders, focus on smaller timeframes (e.g., 1-minute, 5-minute, or 15-minute charts) to capitalize on quick, intraday price movements. They use candlestick patterns, support and resistance levels, and trendlines, while maintaining strict risk management practices.

Longer-term traders, such as swing traders and position traders, utilize higher timeframes (e.g., daily, weekly, or monthly charts) to identify and analyze price action patterns and trends. They focus on larger chart patterns, trend lines, and key support and resistance zones, seeking opportunities with greater profit potential over extended periods. By tailoring price action strategies to suit preferred timeframes, traders can optimize their approach based on their unique goals, risk tolerance, and trading style.

Adapting Price Action Trading to Various Financial Markets

Price action trading can be adapted to various financial markets, such as forex, stocks, commodities, and cryptocurrencies. Each market has unique characteristics, like liquidity, volatility, and market hours, which influence price action patterns and strategy effectiveness.

In forex, traders focus on liquid currency pairs with tight spreads, considering macroeconomic events and central bank decisions. In stock and commodity markets, traders analyze company performance, industry trends, and supply-demand dynamics. For cryptocurrencies, traders account for higher volatility, market sentiment, news events, and regulatory developments. By understanding each market’s nuances and adjusting price action strategies accordingly, traders can capitalize on unique opportunities and increase their chances of success.

Enhancing Trading Performance through Price Action Techniques

Price action techniques can enhance trading performance by providing a deeper understanding of market dynamics and high-probability trade setups. By focusing on raw price data, traders gain a clear view of market sentiment and price-driving forces.

To improve performance, traders should master support and resistance levels, trend lines, candlestick formations, and chart patterns. Combining these elements helps identify entry and exit points and anticipate trend changes. Maintaining discipline and employing sound risk management strategies are crucial for long-term success. Consistently applying price action techniques and refining skills leads to improved decision-making and better trading performance.

Common Mistakes to Avoid in Price Action Trading

Common mistakes in price action trading include overtrading and improper use of stop-loss orders or disregarding risk management principles. Overtrading results in higher trading costs, increased risk, and emotional decision-making. To avoid this, traders should establish clear rules, remain disciplined, and focus on quality trade setups.

Improper use of stop-loss orders exposes traders to significant losses if the market moves against them. Traders should establish a predefined risk-reward ratio and adhere to strict stop-loss placement rules based on price action techniques. Avoiding constant adjustments to stop-loss orders helps maintain discipline and prevents unnecessary losses. Being aware of and addressing these mistakes can improve overall trading performance and increase long-term success chances.

Building Confidence and Consistency in Price Action Trading

Building confidence and consistency in price action trading is essential for long-term success. Confidence comes from understanding price action techniques and practicing them through various market scenarios. Consistency results from disciplined application of a well-defined trading strategy and strict adherence to risk management principles.

To maintain consistency, traders should develop clear rules for trade setups, entries, exits, and risk management. Keeping a trading journal helps identify areas for improvement and ensures consistent decision-making. Continuously refining skills, adhering to the trading plan, and learning from experience helps traders build confidence and consistency, ultimately increasing long-term profitability chances.

Case Studies: Successful Price Action Trades in Real-World Scenarios

Case Study 1: A forex trader observes a strong upward trend on the EUR/USD daily chart and waits for a pullback to the rising trendline. They see a bullish engulfing candlestick pattern and enter a long position, placing a stop-loss order below the recent swing low and targeting a resistance level. As the price continues upward, the trader secures a profitable trade.

Case Study 2: A stock trader identifies a head and shoulders chart pattern on a technology stock, signaling a potential trend reversal. They wait for the price to break below the neckline and enter a short position, placing a stop-loss order above the recent swing high and targeting a support level. As the stock price declines, the trader successfully profits from the trade setup. These case studies demonstrate the effectiveness of price action trading strategies, emphasizing patience, discipline, and a solid understanding of price action techniques.

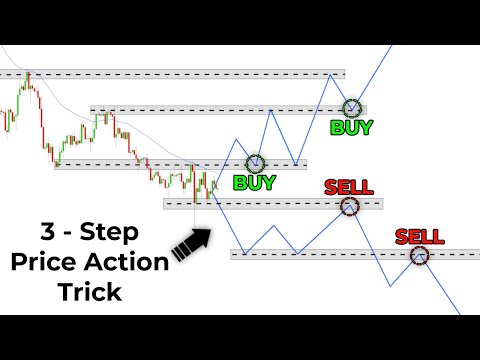

Price Action Trading Video

Price Action Trading Frequently Asked Questions

How Can I Use Price Action in Trading?

To use price action in trading, focus on analyzing raw price data, such as support and resistance levels, trendlines, candlestick formations, and chart patterns. By combining these elements, you can identify high-probability trade setups, potential entry and exit points, and manage risk effectively.

What does price action mean in trading?

Price action in trading refers to the study of historical and real-time price movements to make informed trading decisions. It involves analyzing raw price data, such as support and resistance levels, trendlines, and chart patterns, to gauge market sentiment and anticipate future price changes.

Is price action trading profitable?

Price action trading can be profitable when executed with discipline, a well-defined strategy, and sound risk management practices. However, profitability varies depending on the trader’s skill, experience, and adherence to their trading plan, and there are no guarantees of success.

Topics That Might Interest You